block input tax malaysia

One of the key elements under the GST regime is the recoverability of GST incurred on business expenses by a taxable. 150 Tarikh Kemaskini.

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Exceptional input tax credit claim.

. Trump sues New York attorney general to block fraud probe. Accommodaoti n tax 68 Advance tax on dividend distribution 69 Import and export duties 70 Taxes on individuals 71 Personal. Run GST Processor using wizard 40 92.

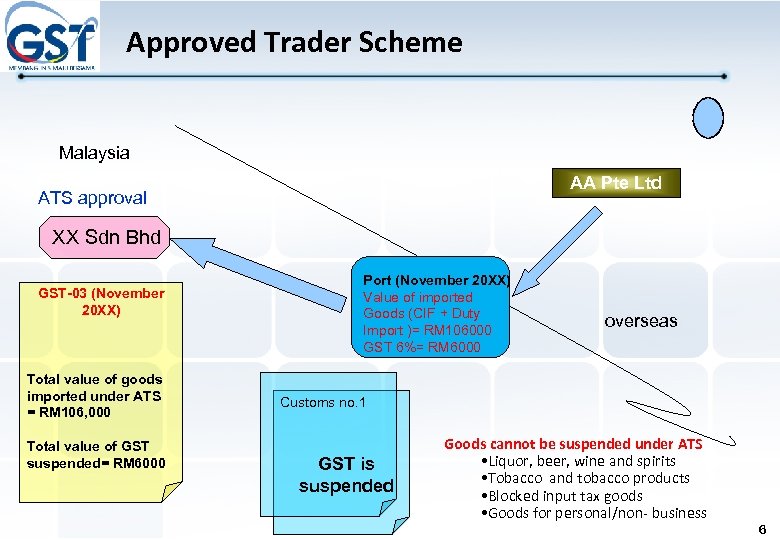

1 The supply to or importation by him of a passenger motor car. Which would be taxable supplies if made in Malaysia. Journal Entry 39 9.

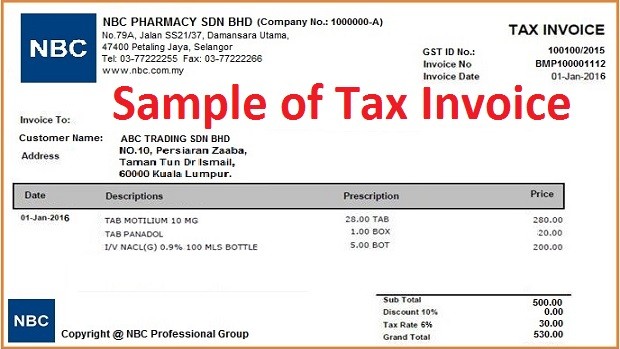

Imposition of Sales Tax 4. The basic fundamental of GST Malaysia is its self-policing features which allow the businesses to claim their Input tax credit by way of automatic deduction in their accounting system. Input tax is defined as the GST incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business.

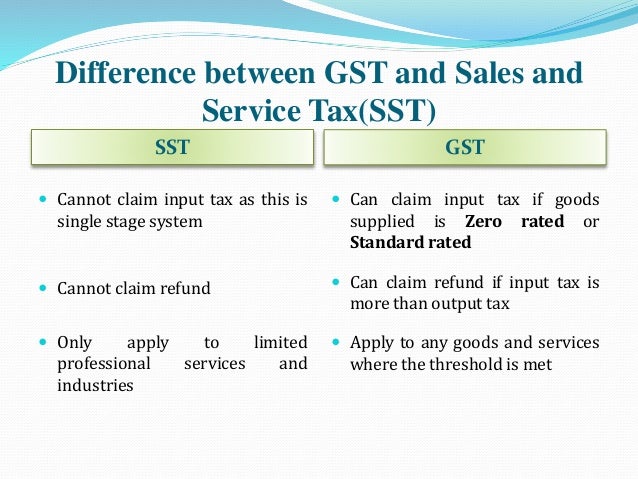

I The SST will be a single-stage tax where the sales ad. C Tax invoice issuance simplified tax invoice i Staff claim reimbursement expenses more than RM500 required tax invoice in PIB name d Block input tax incurred by insurer disallowed input tax. Closing arguments begin in trial of ex-cop Kim Potter.

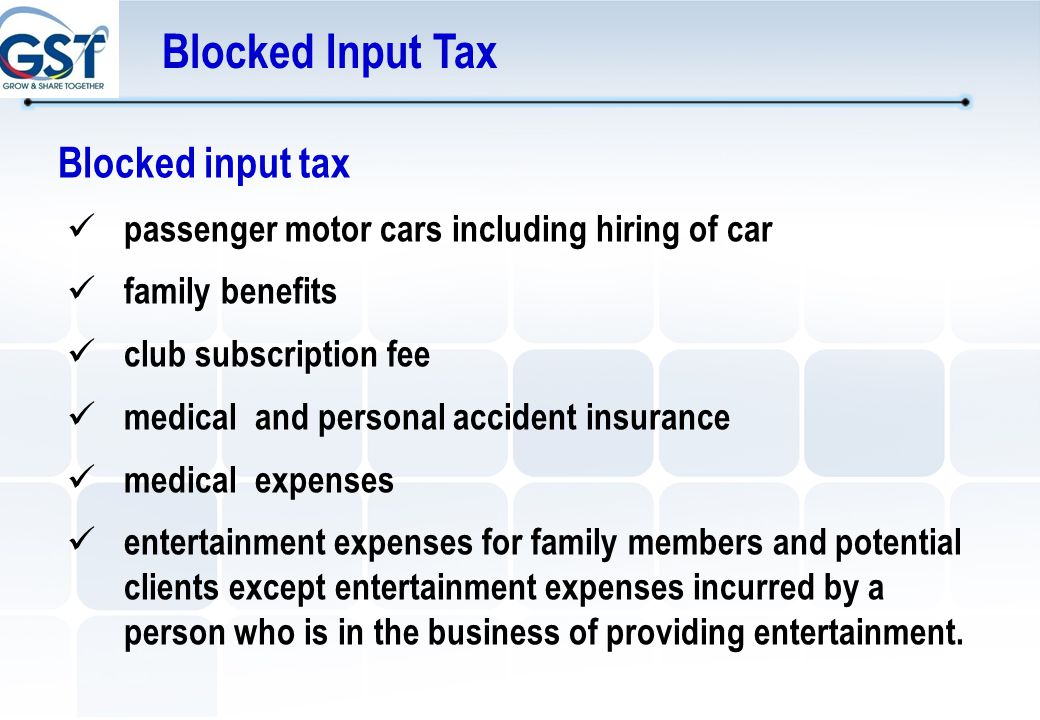

Generate GST Return File 44 94. Under the GST category businesses are allowed to claim GST incurred on purchase of most goods and services. There are goods and service or importation of goods may be denied to claim their credit.

Supply if made in Malaysia. Hurry issued a credit note on. Goods and Services Tax GST is a tax on the consumption of goods and services in Malaysia and is levied on the value added at each stage of the supply chain.

Malaysia GST Blocked Input Tax Credit. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia.

GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns. Generate GAF 45. Cash Payment Blocked input tax 38 84.

Blocked input tax refers to input tax credit that you cannot claim. It is further guided based on Regulation to prescribe on the items that are excluded. 55 Block input VAT 60 Other taxes 61.

ITC in respect of the IGST paid on imports and. B Self-billed - upon agreement between insurers with agent regard on commission payment in written. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

Conditions for Claiming Input Tax. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. Larry Hogan tests positive for COVID-19.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. Property tax 62 Tax on unused land 63 Registration tax transfer tax stamp duty 46. Green fees buggy fees rental of golf bag locker and dining at club restaurants.

For further details please refer to Guide on Input Tax Credit. GST in Malaysia is proposed to replace the current consumption tax. Example 3 Hurry Sdn.

From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. Expenses for use of club facilities Eg. Even nice people have to obey the law.

GUIDE ON VENTURE CAPITAL Draft as at 25 October 2013 7. Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST. On the First 5000 Next 15000.

Malaysia GST - Blocked Input Tax. Bhd a GST registered International Procurement Center undertakes procurement and sale. Setting Default Tax Code 13 a Setting Default Tax Code in general 13 b Setting Default Tax Code by Stock Item 14.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. Family benefits for staff. Employees because it is a block input.

Calculations RM Rate TaxRM 0 - 5000. GST Malaysia Section 4 Non-Allowable Input Tax Bad Debts Relief Record Keeping and Offences Penalties NON ALLOWABLE INPUT TAX While is general input tax is claimable under Standard and Zero-rated supplies there are certain instances where. The cap of 20 on availing input tax credit under the GST rule 36 sub-rule 4 introduced on October 9 will not be applicable on three cases.

Although the tax would be paid throughout the production and. List of expenses incurred by insurer. 2 The supply of goods or services relating to.

Payment of tax is made in stages by the intermediaries in the production and distribution process. On the First 5000. The tax preparation company claims Blocks name and logo are.

The tax advice provider HR Block is suing Block Jack Dorseys financial tech company accusing it of infringing on its trademark. Input tax claims are allowed subject to the conditions for input tax claim. Stamp atx 65 Specific tax on certain merchandise and services 66 Public lighting tax 67.

S38 12 GST Act. Upon the input tax deduction if the input tax amount exceeds that of the output tax the taxable person would be in a refund position where he is entitled to a refund of the exceeded amount from the Director General DG13. Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods.

You should only claim input tax in the accounting period corresponding to the date of the. Configure Malaysia GST 9 42. Input tax claims are disallowed under Regulation 26 of the GST General Regulations.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. GST Processor 40 91. Where there is no amount of output tax in the final return a registered person shall make an adjustment by declaring the amount of adjusted output tax as his input tax in column 6b of the GST-03 return.

Overview Of Goods And Services Tax Gst In Malaysia

What Is Input Tax Credit In Gst How To Get Gst Refund Goods Services Tax Gst Malaysia Nbc Group

What Is Input Tax Credit In Gst How To Get Gst Refund Goods Services Tax Gst Malaysia Nbc Group

Gst Treatment On Manufacturing And Retail Sector Venue

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Overview Of Goods And Services Tax Gst In Malaysia

How Does Gst Affect Real Estate Agents In Malaysia

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Gst Malaysia Section 4 Non Allowable Input Tax Bad Debts Relief Record Keeping And Offences Penalties Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Malaysia Gst Blocked Input Tax Credit Goods And Services Tax

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group